What Is The Average Finance Charge On A Car Loan

Depending on the lender and the type of car loan (i.e. It can have the form of a flat fee or the form of a borrowing percentage.

Get The Highest Credit Score Possible New Credit Card

With a credit score rating above 780, you’ll have the very best shot to get a charge beneath 3% for brand spanking new.

What is the average finance charge on a car loan. New car buyers in the prime credit tier (661 to 780) have the largest loans — $36,386 on average. You have basically two ways to figure out the finance charges you have to pay for a car loan, on a monthly basis or over the lifetime of the loan. A finance charge is a cost imposed on a consumer who obtains credit.

For individual consumers, however, rates vary based on credit score, term length of the loan, age of the car being financed, and other factors relevant to a lender’s risk in offering a loan. The finance charge is equal to the total cost of your loan minus the amount you initially borrowed. Shop around and compare offers from dealerships with offers from banks or credit unions.

The average loan amount for new cars is $34,635, and $21,438 for used vehicles. In texas, the average used car payment was $375, while the. The apr (annual percentage rate) is a percentage of the loan principal that you must pay to your credit union, bank, or other lender every year to finance the purchase of your car.this finance charge includes interest and any fees for arranging the loan.

Some lenders may waive this upfront fee or charge $0 for all customers, while the highest application fee according to savings.com.au's research is $995. Owners of new vehicles paid an average of $567 per month. Finance charges include interest charges, late fees, loan processing fees, or any other cost that goes beyond repaying the amount borrowed.

Finance charges are a form of compensation to the lender for providing the funds, or extending credit, to a borrower. There are other ways as well but it requires spreadsheets and/or finance calculators. Secured or unsecured) car loan application fees are typically between $100 to $500, with an average across the market of about $200.

The positive group assist clients in the areas of car finance, mortgages, insurance & wealth management. Credit score, whether the car is new or used, and loan term largely determine interest rates. The national average for us auto loan interest rates is 5.27% on 60 month loans.

The average apr for a car loan for a new car for someone with bad credit is 18.21 percent. Tom has been in car & asset finance for over 10 years. Finance charge = current balance * periodic rate, where.

Kelley blue book average auto loan rates by credit score. The finance charge is a fee that applies when you carry a balance on your credit card past the due. For example, following is how we calculate the finance charge for a loan of $1,000 with a 18% apr and a billing cyles of 25 days.

Getting a car loan when your credit is between 600 and 699 can be significantly more expensive than it is for borrowers with better credit scores. Without a finance charge, borrowers may be less apt to pay down or pay back their loans. So, there's certainly a wide range of apr for car loans and it's important to know where you'll fit.

The average new car's interest rate in 2021 is 4.12% and 8.70% for used, according to experian. A part of this higher cost are the finance charges that loan grantors charge loan applicants for their service and time. That same group also borrows the most for used cars ($22,708).

The charge gets added to the amount you borrow, and you repay the combined total, typically in monthly installments over the course of the term. Buyers most often use the aid of a car loan to cover the higher cost of a new car. A finance charge is a fee incurred for borrowing money from a lender or creditor.

If you're planning on taking out an auto loan to purchase your next vehicle, it's important to understand how much it's going to cost. The second option is most often used within us. This is how lenders are able to make a profit and lessen the risk of lending.

A finance charge can be a flat fee or percentage of the borrowed amount. The common auto mortgage rate of interest is 4.12% for brand spanking new vehicles and eight.70% for used vehicles, in keeping with experian’s state of the automotive finance market report for the primary quarter of 2021. The amount of money a consumer pays for borrowing money on a credit card.

What is an average car payment? Roughly 86% of new vehicles are financed, according to experian's state of the automotive finance market report for the second quarter of 2020, compared with just 37% of used vehicles. Banks and finance companies sometimes require borrowers who pay off a debt early to pay a fee.

In finance theory, while it represents a fee charged for the use of credit card balance or for the extension of existing loan, debt of credit; Average auto loan interest rates: As of the end of 2019, consumers in california paid an average of $358 per month for used car loans.

Tom regularly contributes articles on car finance, insurance, technology and business growth, drawing on his experience of starting his own brokerage in 2009. For many forms of credit, the finance charge fluctuates as. New balance owed = $4,560.26;

Periodic rate = apr * billing cycle length / number of billing cycles in the period.

Avail LowInterest Personal Loan Personal loans, Low

What is RoadLoans and how can it help me? RoadLoans

FirstTime Seller Tips Understanding Closing Costs Real

Car Title Canada in British Columbia traces finance

What is the average car payment, and what can you afford

Car Loan Payoff Tracking Chart, Dave Ramsey, Debt Snowball

Lenders, why the extra fees? Home loans, Lenders, Cnn money

Car Payment Contract Template Lovely 10 Best Of Car Sales

Tips to repay your personal loan in 2020 Personal loans

How to Get a Good Interest Rate and Save Money Best

The Irony of Tuition Fees in the UK Cashfloat Loan

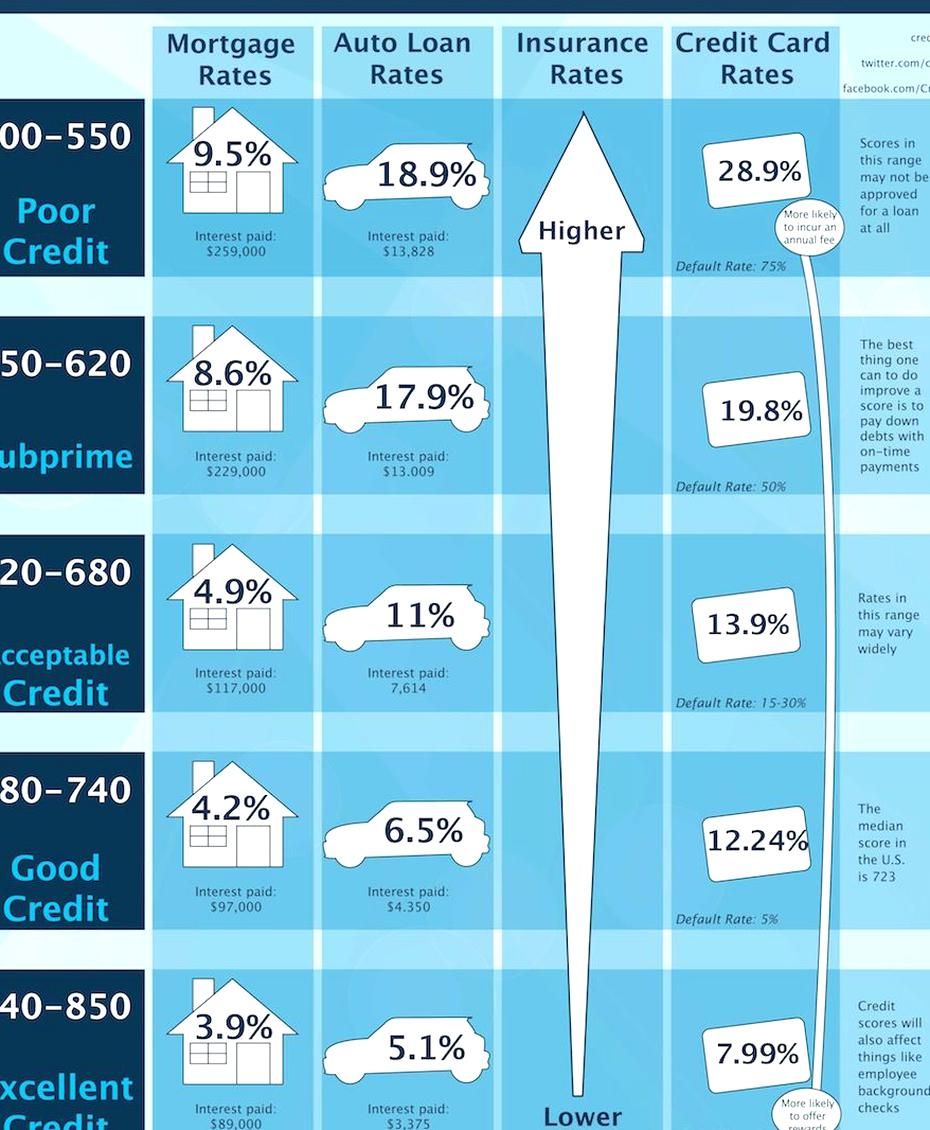

Check out average auto loan rates according to credit

Unique Amortization Table Excel Template xls xlsformat

How We Paid Off 120k In Debt In Less Than 3 Years Debt

Here’s How It Works Once you complete our simple auto

average loan interest rate in 2020 Credit card rates

Our Car Payment was Bigger than our House Payment

Direct Lender Guaranteed Payday Loans No Matter What in

Bad Credit Credit Cards Who Needs Them (With images

0 Response to "What Is The Average Finance Charge On A Car Loan"

Post a Comment